One thing that all of these theories had in common— and, digressing again a little bit, one thing they share with several current theories of economic development — was that they were only about economics. Politics and institutions didn’t matter; only “economic fundamentals” mattered. The ones Rosenstein-Rodan emphasized were how much a society saved and how much foreign aid they got (which in the 1950s and 1960s was assumed to simply add to capital accumulation).Here is the Big Push on Wikipedia.

Big Push theory postulates that one firm's decision to modernize is dependent on other firms decision to do so, and that these firms will not modernize without a minimum amount of initial capital. (In other words - it's kind of like a poverty trap for firms.)

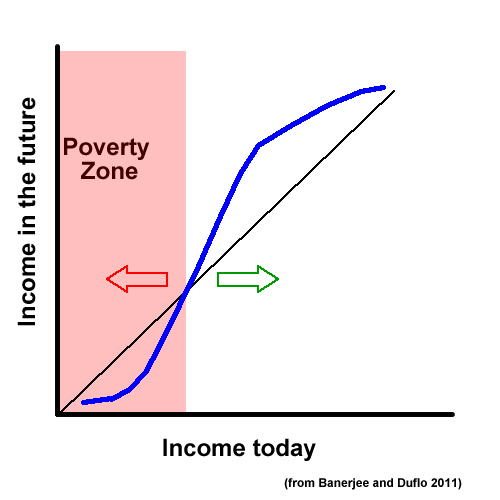

This graphs provide a good demonstration:

As you can see, this "S-curve" shows that in order to attain higher income in the future, there is a steep incline signifying the need for large initial investments. Of course, the ideas behind the Big Push theory isn't widely agreed upon and needs more robust analysis.

Daron Acemoglu and James Robinson's article is saying that the Big Push theory doesn't account for political or institutional barriers, which are especially important in developing countries where the large initial investments would be allocated.

More links:

No comments:

Post a Comment